Oregon's Cultural Tax Credit Information

If you donated to any arts, heritage or humanities nonprofits in Oregon this year, you are eligible to direct a greater portion of your taxes — taxes you’re going to pay anyway — to support cultural projects in the state with the Cultural Tax Credit.

If you think Oregon should provide more funding for arts, heritage and humanities projects, here’s how to do your part:

- Total what you gave to the nonprofits on this list during the calendar year.

- Give to the Cultural Trust online or by mail by December 31.

- On your State Tax Form, report your donation to the Oregon Cultural Trust. You’ll get 100% of it back!*

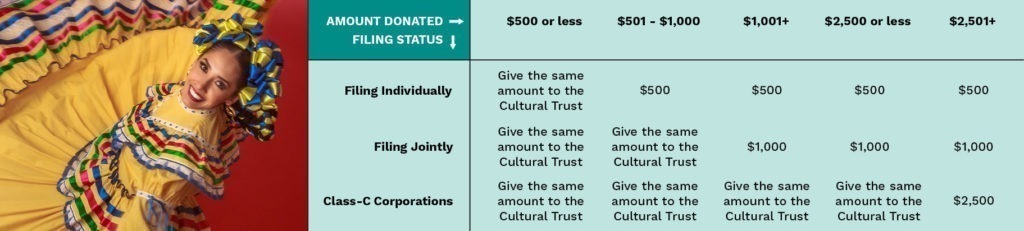

* Up to $500 for individuals, $1,000 for couples filing jointly, and $2,500 for class C-corporations.

By donating to a cultural nonprofit and the Cultural Trust, you can have have an outsized impact on Oregon’s cultural landscape. Here’s an example of how it works:

For more information please visit: